S&P 500 retreated in the pre-PPI uncertainty, offered a great swing entry point in the initial flush to 5,825 support, and then the UoM consumer data lent further support to the buyers – much to the satisfaction of all clients. The intraday ones benefits from my bullish focus on expected SPY and IWM (ES and RTY) leaders and Ellin‘s ES success – incoming data simply favored Nasdaq to lag considerably behind the two.

What spin then does PPI add, what does this title mean?

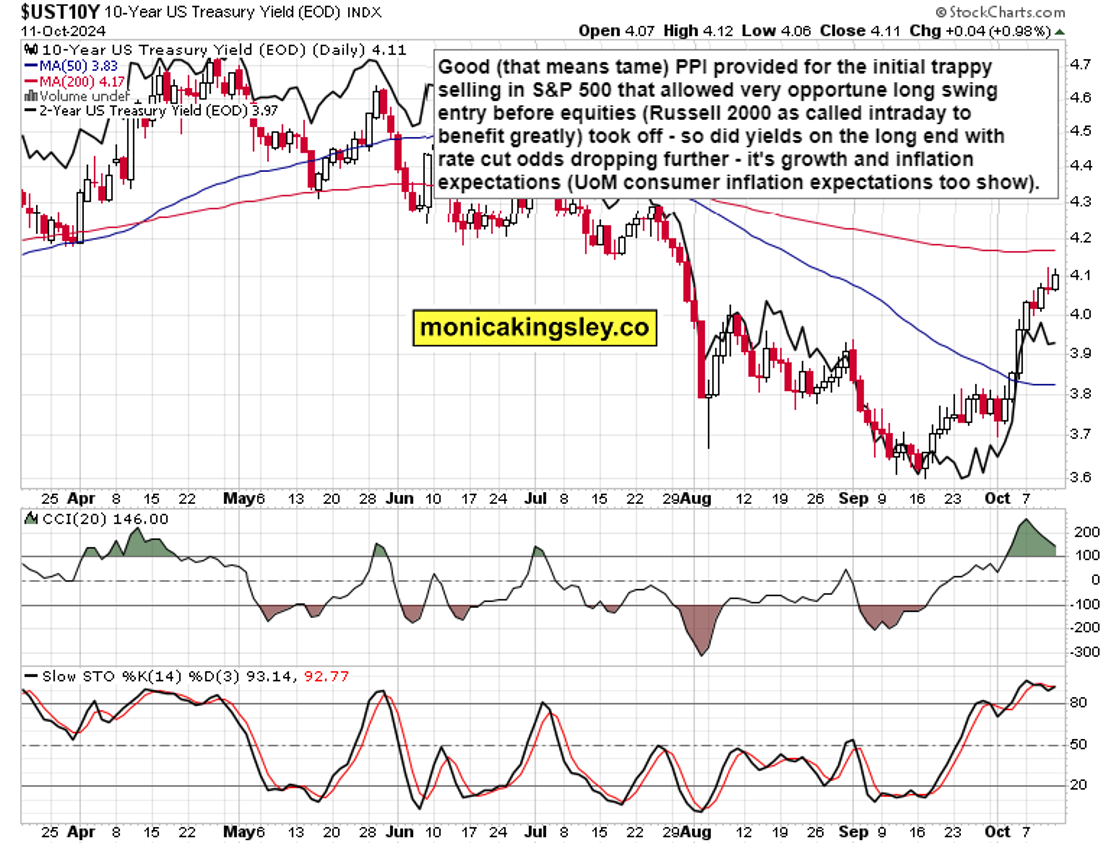

Thursday was about slightly hotter CPI, which means PPI is at odds through coming in tame. Rate cut odds also retreated, offering now not negligible 15% odds of only one more 25bp cut this year. The growth expectation and higher yields on the long end mean that inflation is expected to tick higher down the road, regardless of PPI being tame at the moment.

It‘s about raw materials and energy that I discussed before CPI with clients, therefore we‘re seeing greater risk appetite. UoM consumer data showed below expectations consumer confidence, which speaks for the soft landing engineered thesis – and add to that still some rate cuts ahead (not as many as expected in Aug), which is important for the historical experience of greatest stock market gains happening in the period when soft landing looks to have been secured, right before recession strikes (and rate cuts are evaluated as not reassuring but as stimulative necessity).

Is fear of recession justified? Not in the least, I do not expect recession any time soon, not even early in 2025, to put it mildly. Bostic even lately spoke about skipping some rate cuts. Yields are interpreting the incoming data neatly – and their message has to be squared with the high unemployment claims (some of it due to weather).

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.